Freelance: The catch up.

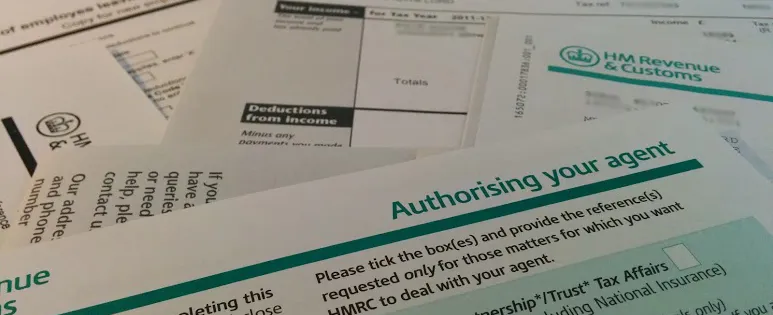

This is what my desk looked like this morning:

Yipee.

4 Weeks ago.

I’m at home for a few days over Christmas. I started a new Job last month, so I haven’t accumulated enough holiday days to take much time off. In fact, I’ve had to pay for these days off.

I’m enjoying coding again. I don’t want to go back. Nobody likes their job though, right?

2 Weeks ago.

Fuck it. I’m definitely going freelance. Time to put the wheels in motion.

Sole Trader vs. Limited Company.

Deciding to work as a Sole Trader or a Limited Company is a seemingly fundamental choice. Though you can start off as one and transition later, it involves going through a period of paperwork hell. Better to just make the right choice now.

Sole Trader:

- Easier option.

- You are self employed.

- Your money is the business’ money.

- More money after taxes when making less than £15k~ per year.

- …

Limitied Company:

- Harder option.

- You and the business are separate legal entities.

- The company has its own bank account.

- You take a salary and dividends.

- More money after taxes when making more than £15k~ per year.

- …

I registered as a Limited Company.

Registering as a LTD.

The Government actually have an online form to register a ltd. It’s £15 if you can get past the very confusing second page. I couldn’t.

I went through Wisteria Formations. They’re pretty good even though their registration form is littered with optional extras. The only one I went for is the printed “Certificate of Incorporation” because apparently it’s required to set up a business bank account. I’ll get back to you on whether or not it was necessary.

Total cost of registration: £34.59

1 Week ago.

Now.

This week I’m:

-

Going to see an accountant for some advice on my next steps (and to check that what I’ve done so far was actually a good idea). I’m hoping they’ll shed some light on the letters I received this morning.

-

Going to the bank to set up a business bank account. At the moment I’m being paid into one of my personal accounts, which is probably bad (since the business is a separate entity).

Disclaimer.

I am not an accountant. I’m writing this as a developer. I have absolutely no idea what I’m doing. I’m just doing the developer thing and picking it up as I go along. I’m destined to fuck something up (and then blog about it). Take everything with a pinch of salt.